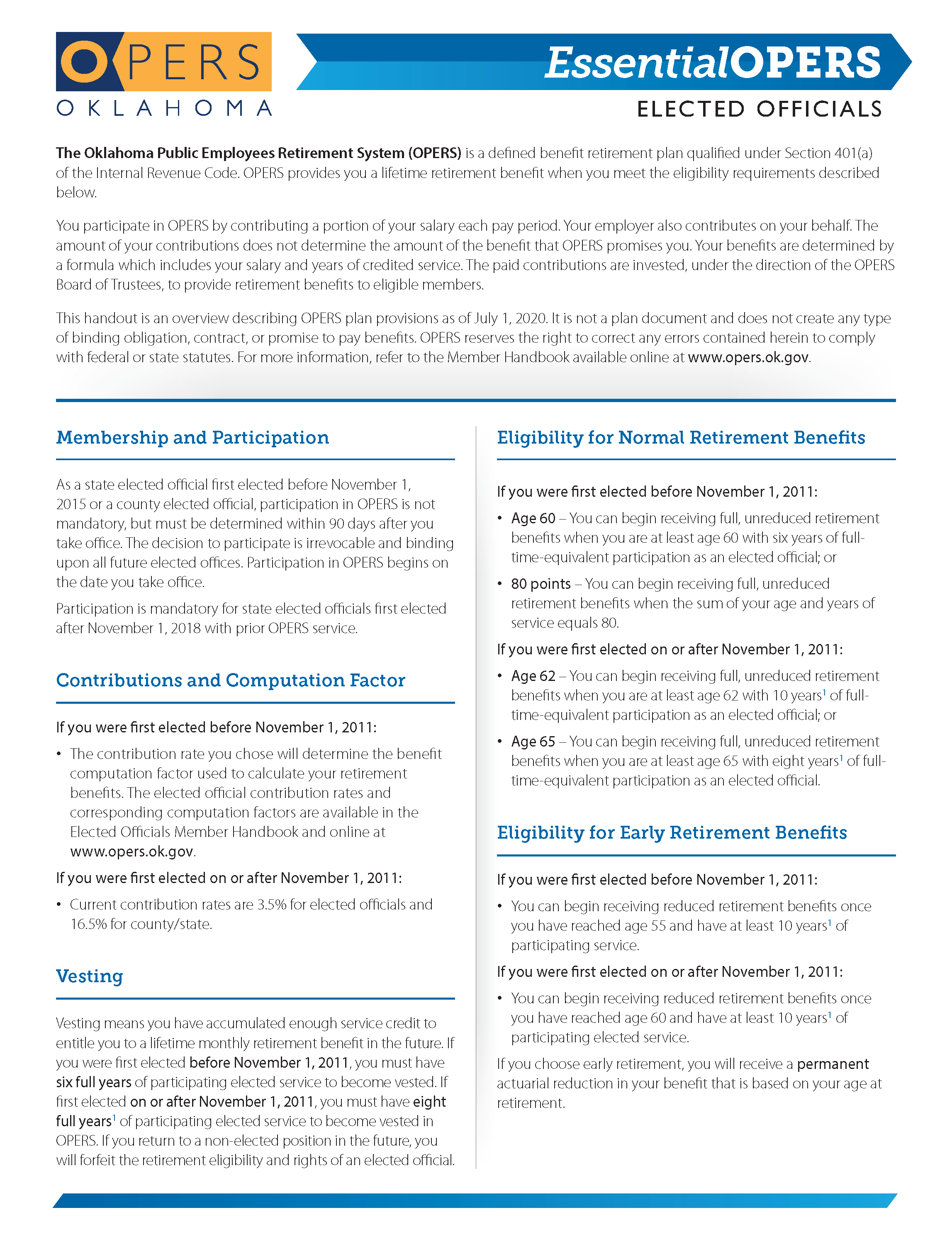

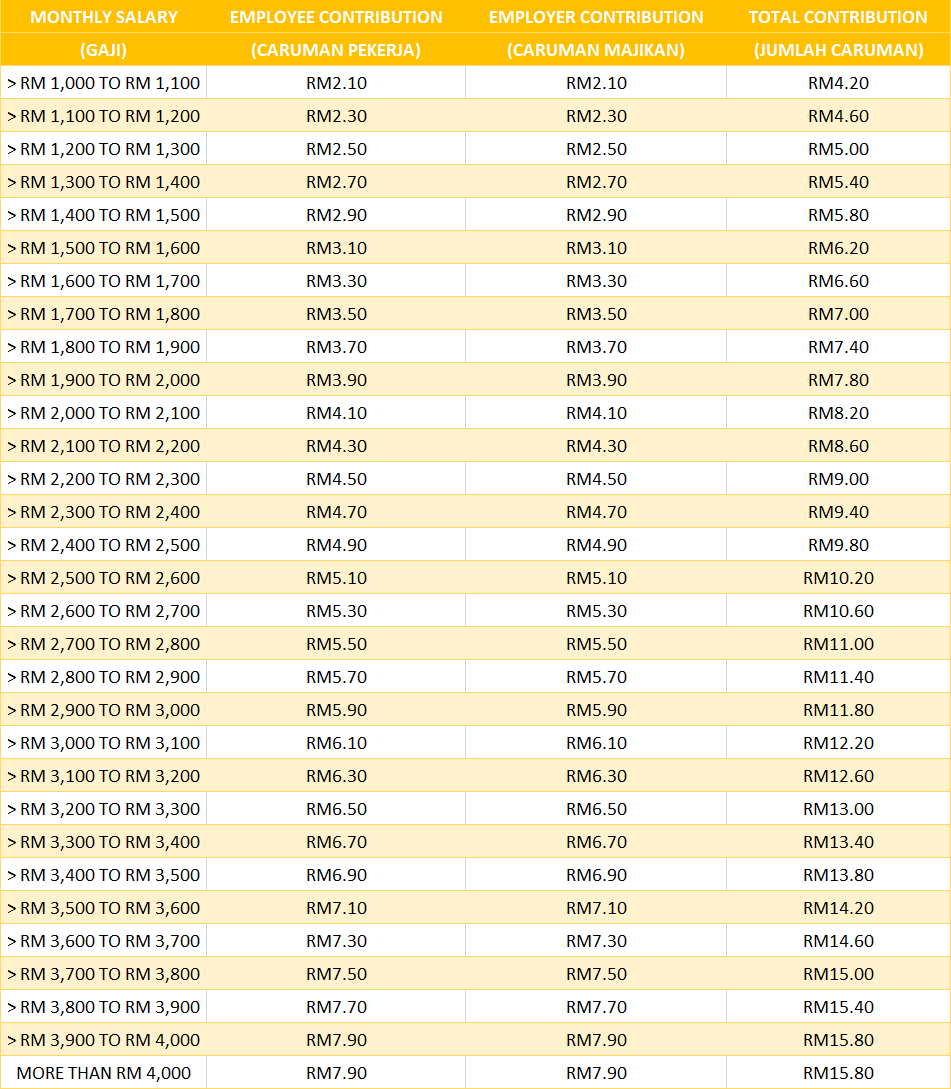

Sip Interest Rate As SIP allows investors to invest small amounts of money systematically instead of a lump sum the investment can be done on a weekly monthly and quarterly basis. Employment Insurance EIS contributions are set at 04 of an employees estimated monthly wage.

After Tax 401 K Contributions Retirement Benefits Fidelity

Wages up to RM30.

. All private sector employers need to pay monthly contributions for each employee. P is the amount you invest at regular intervals. A SIP plan calculator works on the following formula M P 1 in 1 i 1 i.

In the above formula M is the amount you receive upon maturity. Systematic investment plan SIPs today attract nearly Rs. If yes you can claim tax deductions under Section 80C.

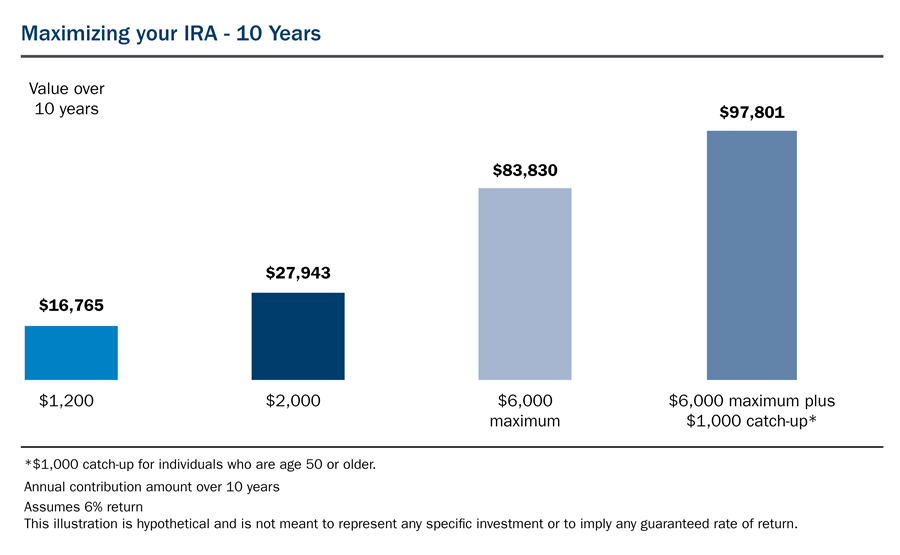

BENEFIT CALCULATOR SIP PRIHATIN Note. You get a rough estimate on the maturity amount for any monthly SIP based on a projected annual return rate. Now let us examine what would have happened had the investor put in 12000 as lumpsum on 2nd Jan13 instead of doing a SIP of Rs1000 per month.

There is no upper limit for the SIP amount. According to the EIS contribution table 02 will be paid by the employer and 02 will be cut from the employees monthly wages. The EPA is responsible for administering the Environmental Impact Statement according to EIS Table process.

This calculation only applicable to Loss of Employment LOE starting from 1st January 2021 until 30th June 2022For LOE happened before 1st January 2021 click HERE to calculate the benefit. 12500 per month to get Rs. If you have any mutual fund queries message.

15 Lakhs tax deduction under section 80C of the Income Tax Act. This calculator helps you calculate the wealth gain and expected returns for your monthly SIP investment. Weve also created an infographic for the EIS contribution rates so that you may download it for reference.

Depending on the Net asset Value NAV of the funds the numbers of units are allocated to the investors. Benefits of SIP as compare to Lump sumps investment. N is the number of payments you have made.

Benefits are calculated based on your previous assumed salary and your Contributions Qualifying Conditions CQC. This calculation only applicable to Loss of Employment LOE happened before 1st January 2021For LOE starting from 1st January 2021 until 30th June 2022 click HERE to calculate your benefit. The employer contributes 12 of salary which is distributed as 833 towards the Employees Pension Scheme and 367 towards the Employees Provident Fund.

Also Add debt component through a fund like ABSL Floating Rate Fund. This contribution is paid for by the employer only and is applicable towards the following employees. SIP mode of investment depends entirely on you.

According to the EIS contribution table 02 will be paid by the employer and 02 will be cut from the employees monthly wages. Additionally the employer also contributes 050 towards the Employees Deposit Linked Insurance EDLI account of the employee. Contribution By Employer Only.

Calculate your expected returns below by entering the amount you want to invest tenure of investment and the expected rate of return. For monthly salarywages gaji more than RM1000 and up to RM4000 you may refer to this infographic of the EIS Contribution Table Kadar Caruman SIP. Rana should reduce contribution to PPF.

For loe starting from 1st july 2020 until 31st december 2021 click here to. FV 1000 x 1 00124 1 001 x 1 001. How do SIP calculators work.

Best Investment Plans Guaranteed Tax Savings Under sec 80C 10 10D. SIP Frequency The frequency of SIP investment is usually weekly monthly or quarterly. I is the periodic rate of interest.

BENEFIT CALCULATOR SIP Note. From the above example you can see that every month the investor is getting different number of units as the NAVs are different but the average price is only Rs. The rate of contribution under this category is 125 of employees monthly wages payable by the employer based on the contribution schedule.

SIP contribution Latest Breaking News Pictures Videos and Special Reports from The Economic Times. In the second category which is calculated at the rate of 125 of the total monthly salary employees are liable for only the Employment Injury Scheme under SOCSO. The fee in the case of SIPUS is a nominal 100 per month for US numbers.

The EPA is responsible for administering the Environmental Impact Statement according to EIS Table process. When wages exceed RM30 but not RM50. According to the eis contribution table 02.

Employment Insurance EIS contributions are set at 04 of an employees estimated monthly wage. The investments can be made in small amount instead of lump-sum. For instance if you want to calculate the FV for a SIP with 1000 monthly contributions for two years and an expected rate of return of 12 this is what the formula would look like for you.

09 Feb 2021 1106 AM IST. 26572 due to rupee cost averaging. Mutual fund managers share their investment journey and how they dealt with bad phases in the market.

Employment insurance eis contributions are set at 04 of an employees estimated monthly wage. If your investment objective is tax savings then you can do an SIP of Rs. Benefits are calculated based on your previous assumed salary and your Contributions Qualifying Conditions CQC ie.

EIS Contribution Table Download. The first category is only applicable to employees who are below the age of 60. SIP Systematic Investment Plan A systematic investment plan SIP is a process of investment wherein the investors can make a systematic periodic investment in market-linked securities for a specific tenure.

All employees who have reached the age of 60 must be covered under this category for the Employment Injury Scheme only. If you are investing in any other open-ended equity schemes through SIP you may not be able to claim any tax deductions on your investments. If you need direct inward dialing DID so that each employee or certain employees can be reached with unique 10 digit number rather than a main number plus an extension there will usually be a minimal additional monthly fee for each DID.

Contributing To Your Ira Start Early Know Your Limits Fidelity

After Tax 401 K Contributions Retirement Benefits Fidelity

Roth 401k Roth Vs Traditional 401k Fidelity

Maximize Retirement Contributions Ameriprise Financial

Publications Oklahoma Public Employees Retirement System

Inventing The Ipod How Big Risks And Crazy Ideas Paid Off For Apple In 2022 Ipod Apple Inventions

Labor Day Bogo Jamba Juice Jumba Juice Smoothies

Life Insurance Or Tax Saving Mutual Funds In 2021 Mutuals Funds Mutual Equity Market

Income Tax Deductions List Financial Planning Tax Deductions List Tax Deductions

Vanguard Roth Contributions Another Benefit Of Your Retirement Plan

Simple Ira Contribution Limits For 2022 Kiplinger

Bispoint Group Of Accountants Who Should Contribute Pcb Epf Socso Eis What Is The Rate Of Contribution How To Calculate Pcb Http Calcpcb Hasil Gov My Index Php Lang Eng Socso Contribution Table Https Www Perkeso Gov My Index Php

Should You Buy Sukanya Samriddhi Yojana Mutuals Funds Economic Times Article Writing

Who Benefits From Proposed Changes To 401 K Catch Up Contributions

:max_bytes(150000):strip_icc()/dotdash_v1_Analyzing_Mutual_Fund_Performance_Mar_2020-012-892c82453f774db082c11d0b52ab31ca.jpg)

Analyzing Mutual Fund Performance

Explained All About How Your Epf Contributions Above Rs 2 5 Lakh Would Be Taxed

Eis Perkeso Eis Contribution Table Eis Table 2021